Global Virus Crisis – April 2020 Update

Cambiar President Brian Barish provides his latest thoughts on the Global Virus Crisis, the current event-driven bear market, and the categories of investment opportunities.

Transcript:

Good day. This is Brian Barish, president of Cambiar Investors. I’m here to talk about the global virus crisis, and the bear market associated with it, and what thoughts we are having that inform our decision making in portfolio management. I’m going to start with the diagnosis. We did a podcast in mid-March talking about this, and this podcast is really to expand a lot on that. We believe this is an event-driven bear market. There have been three different kinds of bear markets since the inception of the Dow Jones Industrial Average some 120 years ago. There are event-driven bear markets. There are cyclical bear markets, and then there are structural bear markets.

So this is almost certainly an event-driven bear market. We know what the event is. It is a COVID-19 virus, and it’s spread throughout the world. But it’s also true that this event is happening at the end of a long economic expansion. Consequently, there are some segments of the economy that need recessing. They have excesses. We need them to get smaller. So firstly, I just want to make a general comment about bear markets. It’s important to understand what you’re dealing with here. Bear markets are a destructive process. They’re very different from a short-term market correction. So market corrections happen. You have one of them, maybe two of them a year. They’re fast. Stocks are down 10% or 12%. Some stocks are down more. If you’re quick, and you’re clever, and you buy the right names, you can make money fairly quickly. A couple of months later, you’d hardly know anything happened.

Bear markets are very different. They tend to go for a while. They happen in waves. There is a process that includes a lot of valuation compression. It includes compression of investor expectations. As a lot of the excesses of the market are weeded out, there is collateral damage to other sectors in the market that maybe didn’t really need recessing but they’re going to get squished anyway. It’s an ugly, ugly process. The only good news we can really find with respect to this one is that because it’s event-driven, these tend to be shorter. They are really a direct consequence of an event.

Now, when you have a more normal, cyclical, or structural bear market, they are set into motion by unsustainable financial conditions, unsustainable economic conditions, and as the central bank tightens liquidity, you get a “cracking” in the market. These unsustainable financial conditions can’t continue. And as that cracking occurs, you get this tsunami-vortex effect where a lot of collateral damage occurs. We’ve seen other bear markets emerge where they’ve coincided with the end of the economic cycle. Two that jump out are the ones at the end of the 1980s and the one in 2008-2009. At the end of the 1980s, you had both the S&L crisis and as well the end of the Cold War.

The latter meant that a lot of the defense complex was shrunk. We just didn’t need to be spending as much on the military. But you had a lot of cities and regions that were very dependent on that form of economic activity, and it had some negative multiplier effects. The S&L crisis was like a mini-credit crisis. You had a lot of poorly thought out lending and aggressive lending, particularly for commercial real estate, and that also got compressed. The more recent and more memorable 2008-2009 recession, you had too much low-quality credit, you had some absolutely ridiculous credit structures that were in the financial system. So the financial system needed recessing. The low-quality credit needed recessing. The housing market, in particular the McMansions, that needed recessing. Consumer debt was too high. That needed recessing. So there were a lot of things that needed to be compressed. Obviously, there’s a lot of collateral damage as the financial sector was badly overleveraged and really seized up.

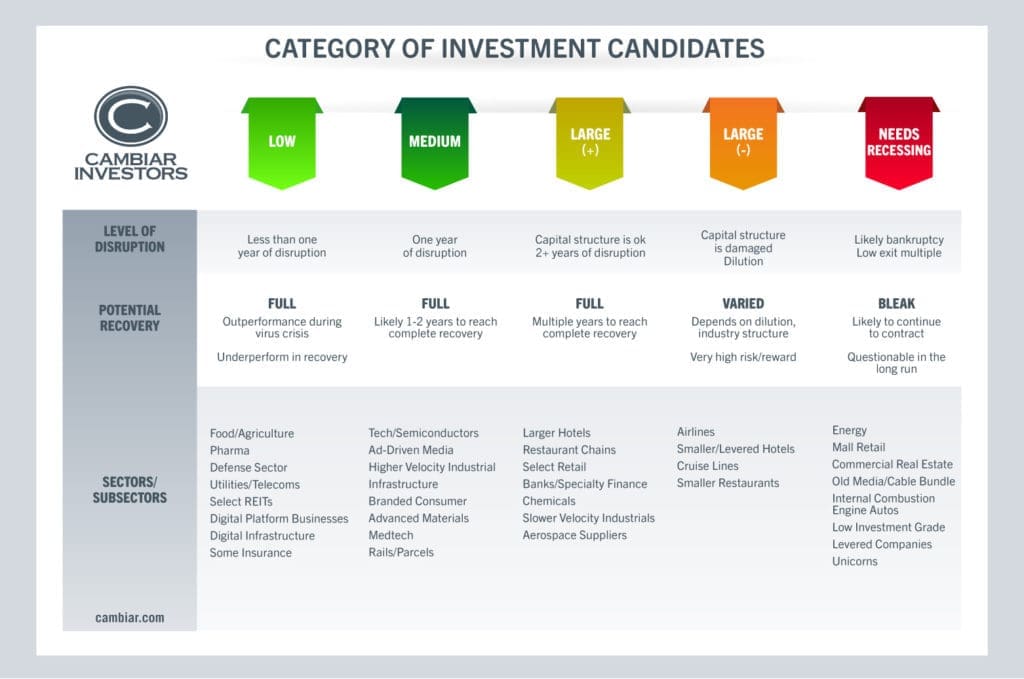

So when we look at the current bear market, it’s important to understand what’s going to happen here. We’re going to have an economic contraction that could border on a depression in order to stave off the worst effects of a global health crisis while we await some kind of medical solution to this. So as this is occurring, we have divided up stocks into five distinct categories. So we had a podcast a few weeks ago. We use three just for expediency, but I think that analysis was a bit too simplistic.

So the first category are our low-disruption stocks. So these are companies where it’s not reasonable to expect any more than mild disruption to their business or their profitability. So these are things in the food agriculture, the defense sector, utilities and telecoms, digital platform and digital infrastructure type of businesses, so the card networks, some of the cloud-computing networks. I think those probably emerge pretty solid from this.

The next category we call medium-business disruption. Medium would under normal circumstances mean a lot of business disruption. These can be higher-velocity, industrial businesses, technology products, branded consumer products, the rails and parcel companies, some professional services companies. In many cases, these businesses will see most if not all of their 2020 profitability wiped out because there’s just no economic activity, there’s nobody to sell anything to. But they will probably recover fairly quickly in 2021 to most if not all of the profits and the trajectory that those profits were on. There’ll be some uncertainty about that and for that reason, they’ll go down more than the low-disruption businesses. But we think you’ll see a fairly full recovery there.

There’s a next category which you almost have to divide into two distinct groups, the large-disruption category. Some of them, their capital structure is going to be okay. They’ll be able to take it. Others, not so much. The loss of revenue, the loss of customers, and just the cost to keep these businesses running, it’s going to be too much to take. So the commercial aviation space has already raised its hand here. They’re not going to be able to take it to have customer counts down 80% to 90%. It’s just not possible. On the other hand, some larger hotels and larger restaurant chains, things like the banks, the aerospace suppliers, they will have a lot of disruption too. It will go on for multiple years, but we do think that in many cases, their ability to restore profitability once the global virus crisis and associated recession is truly over with will be intact.

There’s one last category, which is businesses that need recessing. So we are entering this, as we said earlier, at the end of a long and a very prosperous economic cycle. But that means there are businesses that we think need to get smaller. Starting from most obvious to less obvious, the energy space is an area where the world doesn’t need 14 million barrels of U.S. shale oil. There’s simply no need for it. That needs recessing. Well before the virus erupted, mall retail, and strip malls, and other forms of box retail was in contraction. We expect that process to accelerate. There’s also some commercial real estate office buildings. It seems to me that telecommuting is very, very feasible, and it may be we don’t need as much of that. The old media cable bundle, internal combustion engine cars, those aren’t going to go away so much, but those seem likely to continue to contract and be viewed as questionable in the long run.

One other category that we would highlight where I think you’d want to be very, very careful are low investment grade levered companies. Corporates in the United States and outside the United States have gorged on debt over the last decade in part because interest rates have stayed so unbelievably low for a long time. With those proceeds, they’ve engaged in financial engineering projects and a lot of M&A, some of which have been very, very questionable in terms of the actual benefit to shareholders. Some of those companies are going to find their ability to de-lever their way out of that leverage is going to be very challenged by current circumstances, and we want to be very careful there.

So that’s our dashboard, if you will, for what we’re looking at in terms of disruption, the likely impact to stock prices, and the likely recovery potential. It will obviously vary considerably from sub-sector to sub-sector and from stock to stock. We think it is prudent to consider making investments in the first three categories, and we think it is prudent to avoid making capital commitments in the last two categories unless there are some very special circumstances. The reason is simple. We want our clients’ capital to emerge intact from this bear market, and we think the risks of either substantial shareholder dilution, a capital structure that is just impossible to make money with, or that there just isn’t really that good of a story in any event coming out of this, those are all areas that we want to be careful to not put capital into.

So I’m going to shift gears a little bit and talk about the shape of the recession and the shape of the recovery. It’d be wonderful if we could not have a view of this and just say, “Hey, we don’t really know how this is going to go.” But I feel that it’s impossible to invest credibly without having a view of what we’re in for. We’ve put together several scenarios. We have two baseline scenarios that we think are much more likely and that’s the way that we’re trying to invest. So our baseline scenarios are essentially a lockdown or quarantine of some six to 12 weeks in most of the Western world. We would expect that when the quarantine ends and we get out of lockdown that it’s not going to be totally business as usual, that there still will be social distancing required. You might need to have your temperature taken when you go to the airport. But you will hopefully be able to get back into your place of business and might need to wear a mask, but hopefully able to resume some kind of economic activity.

Depending on how long this goes, whether we get out of our houses in May or out of our houses more like at the end of June, you’re looking at profitability down for corporations in the 55% to 65% range. You’re looking at a loss of economic output that will be on par or slightly worse than the loss of output in the 2008-2009 GFC and related recession. It’s bad. But the path to recovery is hopefully fairly quick. If you recall, the path to recovery coming out of the financial crisis was very protracted. Banks needed to rebuild their capital. The response from the government and the response from central banks around the world was not terribly consistent. In fact, it was consistently inconsistent.

Here, we have a common enemy, which is a virus. It’s not really anybody’s fault as opposed to a lot of your responsible financial and behavioral things that went into the financial crisis. So with the amount of fiscal and monetary stimulus that will be injected into the system, there is a pretty good chance that when we emerge from the virus crisis, the economic recovery will be quite rapid. That’s actually fairly typical of economies coming out of wars. This has a lot more similarity to those kinds of pictures than a normal economic recession.

Now, there’s two other outlooks that we have contemplated. One is a very optimistic scenario where we have a medical miracle and a vaccine or some combination of antivirals proves to be incredibly effective and we’re able to just resume life as normal in the second half and don’t have social distancing for too much longer. We tend to think that’s wishful thinking, and we’re not really investing as though that’s going to happen. If that did happen, you’d want a lot of stocks in bucket number three and maybe even bucket number four because the recovery will be a quick, and violent, and huge, but we just don’t think that that is sensible investing.

Conversely, there is a very dark scenario and it’s worth painting it, and that is where we’re not able to get a medical all-clear in 2020 at all, where we stay on lockdown, the virus keeps coming back, maybe there’s a second lockdown. In the second half, the antivirals and the vaccine prove elusive. That is a dark scenario. We would anticipate corporate profits down by 80% or more. Even the defensive stocks, they will be challenged under that set of circumstances. From an economic statistics point of view, you would actually have a modern depression where GDP falls by more than 10% on a full year, very dark. We tend to discount that one also, not because we’re being naively optimistic, but we don’t want to be naively pessimistic as well. I think it’s challenging to believe that people are just going to refuse to come out of their houses and resign themselves to an impoverished world if this keeps going on and on. I think we’ll cross that bridge when we come to it.

What you had was a re-liquification of the corporate bond and mortgage-backed markets in the first quarter. Once that became evident, the market just started to recover and it never really stopped. So it could be that the signal that ends this is something of similar subtlety. It’s not an all-clear, but antivirals show good promise. Perhaps, we get some phase two data on a vaccine that just looks pretty good. Markets do look ahead, and they will look through some terrible economic and corporate earnings performances if the markets think that this is really over.

So hopefully, this is helpful. Please feel free to reach out to us. Thank you for your continued confidence in Cambiar.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts and other information presented may be based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.