Value vs. Growth – An International Perspective

International value stocks continue to trade at a huge discount relative to their growth peers. We examine the current landscape.

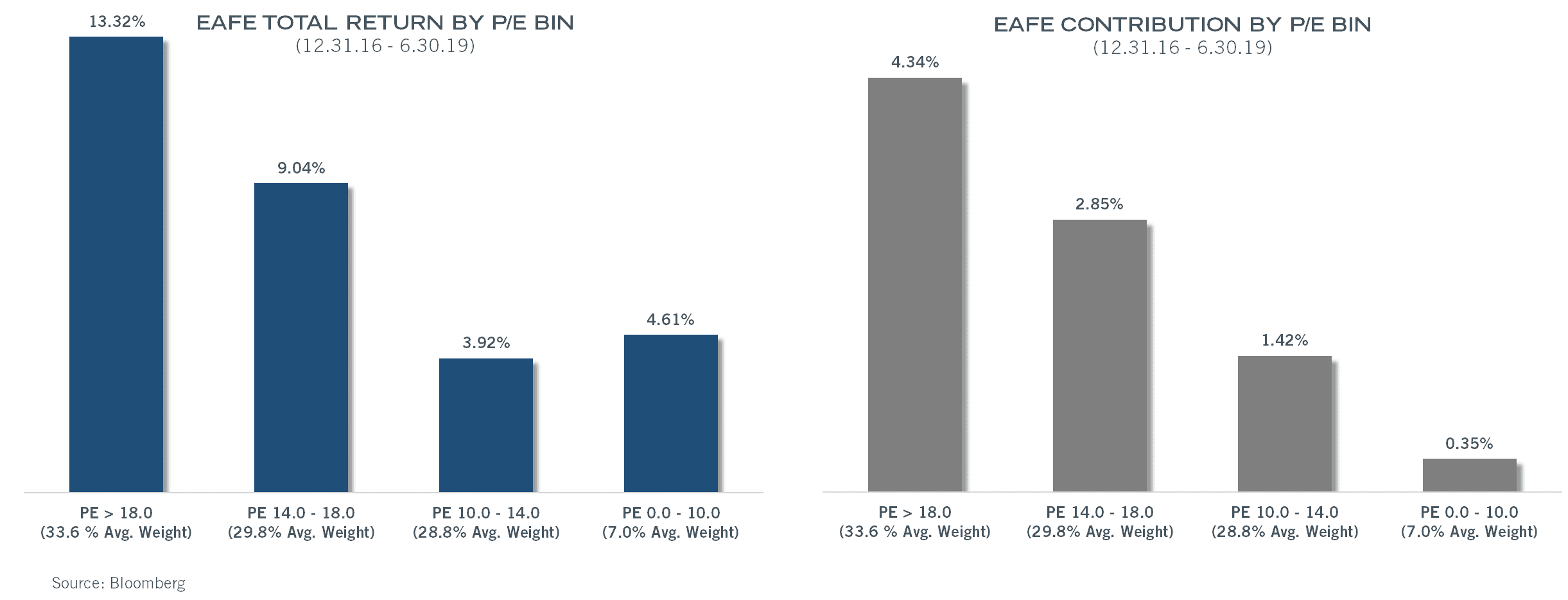

The outperformance of growth versus value within the global equity markets has been one of the more intriguing aspects of the current market cycle. Given Cambiar’s relative value discipline, it has also been one of the most frustrating. But, as the graphs illustrate, there is simply no question about the magnitude of the phenomenon—value is trading at a massive discount to growth, and the gap has been caused by the outperformance of growth stocks.

There are a few key factors that we believe are driving the phenomenon. The first is the combination of cheap money and weak economic growth relative to historical recoveries and expansions. In effect, the scarcity of economic growth we feel favors stocks with “endogenous” growth. In other words, the market is discounting stocks that are dependent on the level of economic activity for earnings to grow, while simultaneously bidding up those companies that do not depend on economic growth, but rather secular trends to propel earnings.

The cost of capital clearly matters as well, in that it drives the discount rate used to value future earnings; in effect, the lower the discount rate, the higher the multiple that can be used on out-year earnings. As such, growth companies with low (or negative) earnings today can still garner large valuations on future earnings. Value companies are likewise punished for lower growth rates and more economically-sensitive earnings streams.

To some degree, we believe disruptive technologies are also playing a role in the growth vs. value divergence; the disrupters generally tend to be in growth industries, while many of these new technologies cause headaches for large numbers of value companies. The most relevant example is the business impact that Amazon has had on traditional brick-and-mortar retail.

Lastly, indexation and the rise of passive investment strategies have also contributed to the outperformance of growth stocks – if only due to the fact that performance drives flows, and as the big winners grow in size and index representation, they are a subsequent beneficiary of larger and larger passive flows.

Since 2017, there has been a greater preference for stocks in the highest P/E segment, with this section of the index returning 13.32%. This resulted in 4.34% of the 8.94% total contribution, almost 50% of the index returns.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts may be based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.