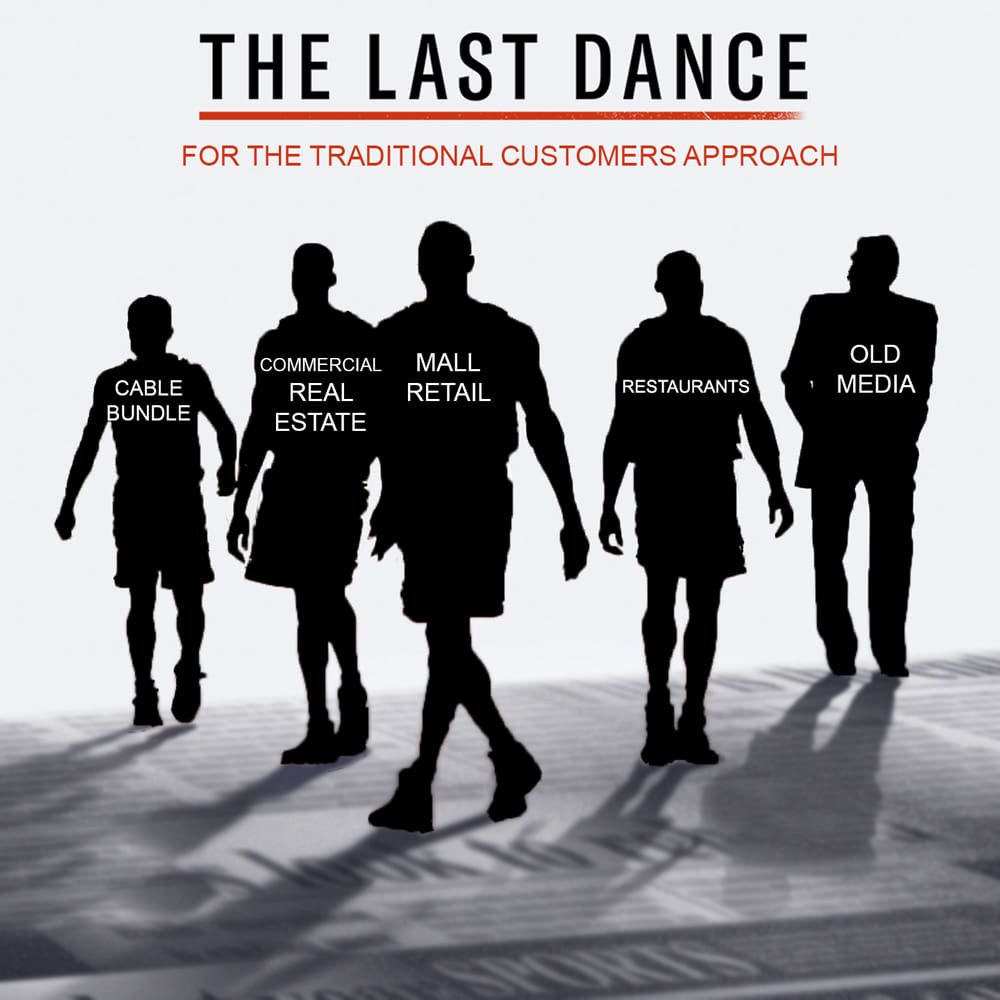

The Last Dance For The Traditional Customer Approach

We examine the acceleration of digital economy businesses during this pandemic.

The Torch Has Been Passed…

There has been no greater excitement for me after having spent two months in confinement than getting to watch The Last Dance docuseries on ESPN about the 1990s Chicago Bulls team. The most epic moment for me by far was watching the Chicago Bulls beat the Bad Boys Detroit Pistons team in the 1991 Eastern Conference Finals. Until then, Detroit was our biggest rivalry as the Bulls lost to them the prior 3 years in a row during the playoffs. As a kid born and raised in Chicago, those losses to the Pistons were gut wrenching. But beating them in 1991 for the first time was a breakthrough moment for the team and the highlight of my 13 year old life at the time. They then went on to beat the Lakers in the Championship and in the words of Magic Johnson, “The torch had been passed.”

Watching the Bulls win the Championship ring in 1991, many basketball fans at the time (including yours truly) felt that they were witnessing the beginning of a new era of leadership. As I am writing this update while waiting for our Uber Eats driver to deliver dinner for the night, I can’t help but think that this Covid-19 crisis is likewise going to bring about a new era for many companies – with some getting better and stronger over time at the expense of various weaker players. This pandemic has given the global investment community a glimpse into the future for many industries, as trends that would’ve normally taken 5-10 years to play out are happening in the span of a few short months. If there were any doubts as to how the digital economy would hold up during tough times, this crisis should remove most of them.

Anecdotes from recent earnings reports via a number of digital economy companies held across Cambiar’s portfolios as of March 31, 2020:

Delivery Hero (European food delivery company owned by Cambiar holding Prosus) added a record 50,000 new restaurants to its food delivery network in the last three weeks of March alone

Delivery Hero (European food delivery company owned by Cambiar holding Prosus) added a record 50,000 new restaurants to its food delivery network in the last three weeks of March alone- Enterprise software company SAP reported a 24% growth in its future cloud bookings from clients during their first quarter despite Covid-19 shutdowns

- Tencent (30% owned by Cambiar holding Prosus) reported a 31% growth in its gaming revenues, 32% growth in online advertising revenues, 26% growth in online video subscriptions and a 50% growth in streaming music subscriptions

- Amazon reported 29% revenue growth across its North American retail division and 33% growth Across its AWS/cloud platform

- Alphabet reported revenue growth of 13% with 55% growth in cloud revenues

- IT Services provider Cap Gemini reported 20% growth in revenues for its cloud and digital transformation revenues

- Ahold (European listed grocery chain) saw online grocery sales grow 38% y/y due to country wide lockdowns

Interesting anecdotes from digital economy companies we don’t own…

- Peloton saw its digital subscribers to its fitness app jump 66% in the first quarter as consumers worked out at home

- Netflix added nearly 16 million net new subscribers in the quarter, nearly double expectations

- Microsoft Teams had more than 200 million meeting participants in a single day in April. It now has more than 75 million daily active users globally, double the number pre-Covid-19

- Uber Eats recorded a 54% increase in gross bookings for food delivery as consumers sheltered in place

- Disney’s on demand video platform Disney+ saw the number of subscribers on its platform grow 65% quarter over quarter to nearly 55 million

We disagree with this notion that investing in growing companies and relative value investing are mutually exclusive concepts.

While we certainly acknowledge that some of these rates of growth are unlikely to be sustainable in the short term as consumer habits return to normal as economies move off of shutdowns; we believe many of these trends are likely to persist (and in some cases only get stronger) as habits become entrenched. For a number of companies across many different industries this will be their ‘Last Dance’ as their futures become eclipsed by new disruptive business models that offer significant value through some combination of better experience, convenience, selection, and costs, not to mention peace of mind around health and safety.

We often get asked how we as relative value investors navigate in a market led by these structurally growing, more digital facing companies. First, we absolutely disagree with the notion that investing in growing companies and relative value investing are mutually exclusive concepts. No stock or group of stocks are confined to growth or value investors. Growth is simply an expected rate of change in cash flows over a specified time horizon while value is the discount between the net-present-value of those cash flows relative to the actual stock price today. That discount can persist in a structurally growing business or a cyclical business. We’re indifferent. We only want to ensure that we have a combination of both durable and structurally advantaged businesses along with a margin of safety embedded in any stock we underwrite as opposed to looking squarely at potential upside.

As investors first and foremost, Cambiar prefers to own what we believe are advantaged businesses rather than the opposite. Owning structurally advantaged companies is a key part of our investment philosophy. Take for example two of our holdings Prosus and Alibaba. Prosus, listed in Amsterdam, and trades for €69 per share (as of 4/30/20). Prosus, in our view, owns and manages some of the most attractive digital assets in the world while trading at a price that is entirely inconsistent with the underlying value of those assets. The company owns a 33% stake in Tencent worth €104 per share currently. Tencent is one of the most innovative and dominant online platforms in the world. Tencent is the largest gaming company on the planet with 50% market share in China alone. Tencent’s mobile payment wallet called WeChatPay is a duopoly and second only to Alipay (owned by Alibaba) in the country. The company has a fast growing online advertising business and the second largest cloud platform in China. The company’s music platform is the leading streaming music service in the country and Tencent video is now challenging for pole position in terms of online video streams. Furthermore, Prosus’ current online classified segment called OLX is conservatively worth another €10 per share. In addition Prosus owns a 20% stake in Delivery Hero, a fast growing and well positioned European food delivery platform worth €3 per share. Finally Prosus is sitting on another €4 per share in net cash. All in this is a business whose stock we think is conservatively worth much more than its current share price implies.

As investors first and foremost, Cambiar prefers to own what we believe are advantaged businesses rather than the opposite. Owning structurally advantaged companies is a key part of our investment philosophy. Take for example two of our holdings Prosus and Alibaba. Prosus, listed in Amsterdam, and trades for €69 per share (as of 4/30/20). Prosus, in our view, owns and manages some of the most attractive digital assets in the world while trading at a price that is entirely inconsistent with the underlying value of those assets. The company owns a 33% stake in Tencent worth €104 per share currently. Tencent is one of the most innovative and dominant online platforms in the world. Tencent is the largest gaming company on the planet with 50% market share in China alone. Tencent’s mobile payment wallet called WeChatPay is a duopoly and second only to Alipay (owned by Alibaba) in the country. The company has a fast growing online advertising business and the second largest cloud platform in China. The company’s music platform is the leading streaming music service in the country and Tencent video is now challenging for pole position in terms of online video streams. Furthermore, Prosus’ current online classified segment called OLX is conservatively worth another €10 per share. In addition Prosus owns a 20% stake in Delivery Hero, a fast growing and well positioned European food delivery platform worth €3 per share. Finally Prosus is sitting on another €4 per share in net cash. All in this is a business whose stock we think is conservatively worth much more than its current share price implies.

Alibaba is the dominant e-commerce marketplace, cloud infrastructure provider and mobile wallet platform in China. Cambiar purchased Alibaba during the recent crisis. Alibaba’s share price and market cap has remained largely flat since 2017, despite earnings for the company – almost more than doubling (through year-end 2020). As a consequence, at the current price of $203 per share (as of 4/30/20), we believe we get to own Alibaba’s core e-commerce marketplace at a historically depressed valuation, while receiving the company’s dominant cloud infrastructure and payments platforms essentially for free. Alibaba’s e-commerce marketplaces (called Taobao and TMall) have a combined 960 million annual active users and deliver 57 million packages a DAY. 60% of all products purchased online in China go through the Alibaba marketplaces. Alibaba’s cloud platform (called AliCloud) commands 45% market share in cloud infrastructure services in China, larger than the next four players combined. AliCloud generated roughly $5 billion in revenues in 2019, and we think it can easily double over the next 2-3 years. It is important to highlight that AliCloud was just a fraction of itself a few years ago. In addition, Alibaba’s payments brand (Alipay) was valued last year at around a $150 billion market cap; this is effectively one of the largest privately held companies in the world, akin to PayPal, but exposed almost entirely to China. Alipay accounts for 55% of all mobile payments in China. In our estimation, these two free options (AliCloud and Alipay) are worth somewhere between $40-$50 per share relative to Alibaba’s current share price of $200. All in, we believe Alibaba’s current share price meaningfully ignores the underlying intrinsic value of this company.

Are Prosus and Alibaba growth or value stocks? Clearly, both are structurally growing companies –yet we believe they also offer definitive value and subsequently an embedded margin of safety at current prices. As a firm, Cambiar will continue to look for and identify companies that are playing offense by disrupting the status quo. But as Michael Jordan said on three different occasions after holding the championship trophy, “Defense Wins Championships.” In fact, a strong defense is an aspect of Jordan’s game that often gets under appreciated. We agree with MJ, and seek to deploy defense for our clients via ownership of structurally advantaged businesses that offer both a margin of safety as well as attractive upside over a forward 1-2 year time horizon. We believe this focus on quality companies that possess strong balance sheets and a defensible margin structure should provide a degree of resiliency should the current downturn continue, while taking share as the global economy begins to slowly normalize.

All company specific data was obtained from their most recent earnings reports.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

The specific securities identified and described do not represent all of the securities purchased or held in Cambiar accounts at March 31, 2020, and the reader should not assume that investments in the securities identified and discussed were or will be profitable. All information is provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts and certain other information may be based upon third party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.