Market Insights – 3Q19

Cambiar President Brian Barish provides his latest thoughts on global markets and the fear of the “bonk.”

Global equity markets generated mixed results in the third quarter of 2019. U.S. large-cap stocks generated a small gain in the quarter, while smaller cap U.S. stocks and international stocks generated slight losses in U.S. $ terms. Emerging market equities performed worst, declining by over 4%. Most of the international losses could be assigned to U.S. dollar strength as the dollar rose approximately 3% in the quarter versus a basket of other currencies. Equity trading was uneventful and we did not have a lot of activity.

The scarcity of global yield has driven investors to extremes, including a preference for dollar assets and high yield where it can be found.

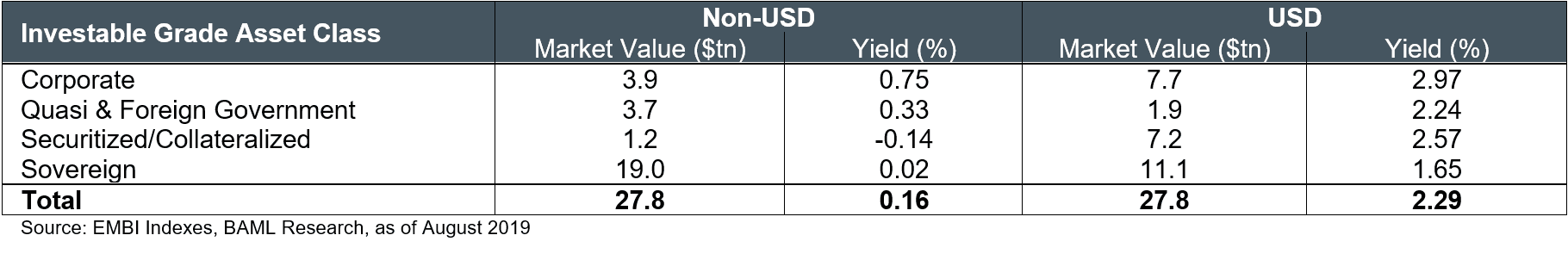

There was more interesting action in bonds, some obscure “quantitative” finance developments, and the outer fringes of stock markets. Following a surprise populist election result in Argentina in April, the Argentine stock market lost 48% in dollar terms in one day, the second-largest daily decline on record for any stock market since 1950I . The U.S. yield curve inverted across the highly watched 2-10 year spread, and outside the U.S., negative yields plumbed new depths. Negative yielding debt hit a global high of $12 trillion in 2016 during the Brexit-panic mid-summer, but blew through these levels to amounts exceeding $17 trillion in the summer of 2019. The lack of yield in reserve currencies has led to a chase for yield globally, resulting in a (truly) extreme concentration of yielding paper by currency. Because the ECB and Bank of Japan employ negative interest rate policies for central bank deposits, reference yields on sovereign bonds in these regions have also plummeted to negative or negligible levels, while investment grade (IG) bond yields in Yen or Euros are similarly low or non-existent. Looking at world bond markets, the amount of debt in issue is roughly 50/50 in terms of dollars and non-dollar reserve currencies. As a result, the stock of available coupons on IG debt has skewed heavily to dollar-denominated debt, such that about 95% of the world’s IG bond coupons occur in dollars – truly unbelievable! The scarcity of global yield has driven investors to extremes, including a preference for dollar assets and high yield where it can be found. Hence, it’s not surprising that just two years ago, a chronic sovereign defaulter in the form of Argentina managed to issue 100-year bonds (denominated in what else, dollars). Following the political shift and presumably anti-market propensities of Argentina’s new government, said 2117-maturity bonds trade at 40% of par just two years after their issuance.

Within a couple of days of the ECB meeting, global interest rates moved up from historically low levels; this seemed to trip the wires of quantitative equity strategies. Bond prices fell (though Eurozone rates remain profoundly negative), momentum stocks fell, and “value” stocks rose more or less across the board in Europe and the U.S. The move was reported by some newswires as being a 4-5 standard deviation relative-price move. This was in the context of low August volumes and a year-to-date spread between growth and value stocks that was already quite extreme; thus perhaps the seismic nature of the move should be discounted a bit. Quant strategies appear to, among other things, extrapolate existing price and momentum trends, even at the extremes, creating the potential for sharp reversals if certain variables deviate from the trend. In this case, rates may have bottomed. Weak industrial trends in Europe prompted the ECB to lower its already negative interest rates a further 10 bps (to negative 0.50%) and restart various bond-buying programs in mid-August. This was the last action of ECB President Mario Draghi, who moved on from his position on November 1. Draghi is fairly credited with creative financial maneuvering and jawboning to keep the Euro together in the early 2010s, but history may question whether the continued application of emergency policy measures, including five years of negative interest rates, didn’t result in meaningful economic distortions that may be costly to unravel. The rate decision went through despite an unusually high number of ECB board members dissenting, in some cases vehemently.

Value investing has lagged persistently this decade for a variety of reasons – among them an academic argument that extremely low rates favor growth stocks more than would otherwise be the case. In a typical DCF, the “terminal value” in years 5+ of the valuation exercise comprises about 70% of the value of a stock, though with risk-free rates pinned close to zero, the terminal value can be as much as 85-90% of the calculation. Armed with this logic, it has made sense for the management of growth businesses to barrel forward as hard as possible, with some indifference to short term profitability. And this they have done, with many successes. It does create the potential for aggressive and untested business models that would seem vulnerable to shifts in the financial winds; however, and for some big dream business concepts to grow to extraordinary implied valuations outside public markets without much associated profitability. As these jumbo-sized unicorns have attempted to become publicly traded, public stock markets have been not nearly so accommodative.

At the end of 2018, we made note of the sharp deceleration in money supply growth (measured as M2) to levels below nominal GDP growth. A deficit of money supply growth assuming constant money velocity leads to poor financial asset price performance – thus 2018 was a negative year. 2019 looks to be the opposite, with money supply growth accelerating to fairly robust levels.

From a bigger picture economic perspective, limited internal demand in the developed world ex-USA places undue pressure on U.S. and Chinese growth to fill the void. This is far from an ideal global-growth model, and it has shown its vulnerability, particularly as industrial orders have declined. For much of 2018 and 2019 to date, the economic picture has been clouded by an industrial deceleration to outright decline, depending on the region and sector. The epicenters of the slowdown are major higher value-added capital goods countries such as Germany and Italy, where industrial production surveys have fallen into contraction territory, and China, where local consumer demand has been dented by declining confidence and decreased business capital spending. The trade war and vague but persistent threats of escalation, have had a chilling effect on the locals, on the willingness of businesses to add capacity in China (versus alternative sourcing), on inventory stocking levels (very low), and on long term planning horizons. While U.S. economic growth has held in a reasonable but not thrilling level, European growth is barely positive, and Chinese growth appears to be entering a different phase altogether, with the capacity to grow exports and move up the value-added ladder compromised by external pressure from trade and shifting internal priorities.

Though the data has generally been poor in 2019, the rates of decline in inventories and business conditions for manufacturing companies seem to be bottoming out recently. Coupled with the significant improvement in money supply, this argues for better financial conditions than today’s exceedingly low-interest rates would suggest.

The Odd Business of Global Bonk Prevention

An outsized number of financial professionals participate in endurance sports, such as marathon running, triathlons, and cycling. It’s a curious sociological topic – why are finance professionals so frequently attracted to these suffer-fests, exactly? Maybe it’s a control thing. You control all of your own personal physical variables, which is hardly the case in public financial markets. It feels competitive, even though it isn’t exactly except for the small handful of top athletes in an event. There’s an endorphin rush, but does one need 7+ hours of endorphin release? While I once found myself asking these questions cynically, I took up cycling eight years ago and quickly seemed to understand the urge to explore one’s own limits and to see what’s possible. It becomes more than just a time-consuming diversion, but a compulsion that seems to mitigate the natural stress of a professional life in finance.

The endurance athletes out there will surely understand the slang term “bonking”. For the non-endurance athletes out there, the verb to bonk means that you have run out of energy in your muscles and other organs and are not able to convert body fat into energy quickly enough to sustain performance in your muscles and brain. And thus you suddenly can barely move, or hallucinations of tiny purple elephants appear on the rock formations you are riding by. It is probably derived from more colloquial phrases such as “I bonked my head against the door”. A door-head bonk probably just equals short-term pain, but a mid-event bonk in an endurance sport means that however hard and well you have trained, the numbers you are targeting to meet or beat are definitely not going to happen. In other words, you are going to fail at the one thing you have been training your tail off for in this pseudo competition. Negative endorphin releases quickly follow.

If you participate in endurance events, bonking is something you may have experienced and almost certainly will have some fear of suffering in an event. There is actually a good deal of science behind the bonk and how/why it arises. An average-sized male has about 400g of glycogen stored in his muscles and another 100g of glycogen stored in his liver, or about 2,000 calories worth of exertion. This store of glycogen releases pure energy to the muscles and is the primary store that the body will first deplete. On a 10k run, you won’t dip very far into these reserves. But on a 100-mile bike ride, running out is distinctly likely. The body can and will replenish these reserves from fat or from food ingested during the event, but can only do this at a rate of a couple of hundred calories worth per hour. Very well-trained athletes can burn fat more rapidly, but on a long enough event, fat-burning only just isn’t fast enough. Complicating matters further, the brain is a glutton for energy consumption and does not store its own glycogen. It runs on liver-stored glycogen only, of which there are about four hours worth under normal circumstances. As liver glycogen runs out, motivation, decision making, and agility can falter. The brain perceives fatigue, even though your muscles may be fine. In a sufficiently glycogen-starved brain, neurons misrepresent incoming images. Orange cones become furry animals. Rocks become purple elephants. And self-motivation generally falls apart. Having endured two total bonks myself, whether brain-led or muscle-led I cannot say, there’s no way to forget what it’s like to totally shut down on a highway in the middle of nowhere, or riding up a mountain over 12,000 ft.

The omnipresent fear of bonking is where the spirit of entrepreneurial free markets has come to bear to create a mini-industry unique unto its own: sports nutrition, the unconventional nutritional policy of fueling during unnaturally long endurance events. Glucose and carbohydrate-dense drinks and bars pack a wallop of extra carbohydrates that rapidly materialize into glycogen if you happen to be running low, and, depending on your exertion levels and tolerances, can be closely tuned to match glycogen demand. Common wisdom once had it that one should consume slow-burning carbohydrates just before a race. The digestive system has a very limited capacity to process more complex forms of food under high exertion levels, leading to various forms of trouble during an event. Fast-burning (high-glycemic) carbs – those milled to a particulate size not seen in nature prior to the invention of the Ding Dong – are among the main reasons most Americans are overweight. In sedentary people, they cause a fat-packing insulin spike followed by a blood-sugar crash. Less so in athletes, but they still can foul up your body chemistry as the super sugar spike affects hydration.

Thus, optimizing carb intake along with other nutrients becomes an hours-long body policy fine-tuning management challenge, with any number of small-time entrepreneurs throwing their bar/nutritional blends into the grocery aisle replete with performance testimonials and other nebulous science. It’s also worth noting that, outside of the more extreme athletes out there who may be able to absorb these carb bombs a bit better, the simple rice cake or mini bagel does seem to work as you push into the 4+ hours of exertion zone. Put differently, fear of bonking often leads to far more aggressive cocktails of supplements than are necessary. Too many bars with 40 miles to go is a uniquely bad feeling…and if you think you are bonking just halfway into an endurance ride, odds are that’s not a bonk, you are just out of shape, and the bars are superfluous calories.

If the reader will bear with the challenged analogy, the industrial sector of the economy is the brain and the service sector the muscles of the endurance athlete in a very long-running economic expansion that is understandably worried about the bonk. With industrial output falling and inventory levels low, the more sensitive parts of the economy are running low on fuel in the form of physical production. Policymakers fear a slip into recession. And yet – unemployment is exceptionally low, with quality workers more or less unavailable in material quantities. Are we seeing recessionary purple elephants marching across the road? Is this just a mental versus physical bonk that has the markets concerned?

In the U.S., Fed policy has been more of the rice cake (conventional carb) approach, titrating Fed reserves in the system back up to appease short term funding and liquidity pressures, while tapping down on the Fed Funds rate to a level more consistent with inflation in the last ~10 years at less than 2%. Europe and Japan have taken the triple strength Clif Bar approach, throwing everything at the system to sustain performance, and yet growth rates remain anemic. No, I am not sure it’s really necessary or causing much improvement versus the alternative.

The better plan, seems to us, not to over-analyze the economic tea leaves and focus on picking up good businesses where they may lie.

Recent Activity – International

As mentioned earlier, the markets have not been especially eventful in the summer of 2019, but the mood has been sour, with defensive stocks and acyclical growth stories holding much higher valuations than alternatives in the markets. Accordingly, we have tended to find more volume and sentiment-sensitive names attractive.

Cambiar’s International Strategy made three purchases in the quarter: hospitality company Accor, German utility RWE, and French tech services company Cap Gemini.

Accor (AC.FP) – is a major global hotel operator in the process of transforming its business model into that of an asset-light operator in the vein of peers Marriott, Hilton, and Intercontinental. In an asset-light model, the brand owner derives revenue from selling the brand via management and franchise contracts leading to generally superior margin and cash generation capability relative to asset-heavy peers. Accor’s portfolio of brands ranges from well-known luxury names such as Raffles, Fairmont, and Sofitel to more midscale and budget names such as Mercure, Novotel, and Ibis. Accor enjoys broad geographic incumbent positioning and pipeline, and also offers an opportunity for the return of capital to shareholders as the asset-light transition and ultimate simplification of the business model is completed.

The U.S. is the most mature market in terms of hotel brand penetration at 72% of total rooms, with chain rooms growing at 2.3% y/y currently. In contrast, Europe is at 38% brand penetration (including even countries like the UK and France at under 50%), with chain rooms growing at over 4% y/y. Further, U.S. revenue per available room (RevPAR – an industry amalgamation of occupancy and pricing) is currently 8.2% above its 2007 peak, while Europe is still 8.5% below its prior peak and with evidence that the cycle can continue. China lies somewhere in the middle at 48% brand penetration; however, the market is unique versus the other two in that brand penetration is concentrated in the economy segment with the middle tier largely untapped. Accor also enjoys idiosyncratic strengths in China such as a partnership with Huazhu, a major domestic operator, and since 2014 has held the master franchise agreement for Accor’s Mercure and Ibis brands in China, Taiwan, and MongoliaII.

Accor currently trades at a discount to both peers as well as its own historical EV/EBITDA multiple, despite what we believe are better longer-term runways given lower rates of branding penetration outside the U.S.

RWE (RWE.GR) – is an integrated German Utility focused on the power generation side of the business. European electric regulation and Germany’s, in particular, has been uniquely challenging in the 2010s, as Germany more or less forced its utilities to idle nuclear capacity and saddled them with various nuclear and other legacy liabilities earlier in the decade. This has resulted in deep restructuring among incumbents. European regulations are much more aggressive in steering industries to low carbon and ultimately, non-carbon sources of power, creating an ample price umbrella for renewable sources of energy, among other market-based incentives to align capital interests towards these goals.

RWE is a leading renewables and conventional power generator (upstream) while exiting its distribution and client services businesses (downstream, swapped to E.on, another Cambiar holding more focused on distribution). This transformation is the core of our investment case. The road ahead for power generation in Europe is very constructive for renewables. Investments in efficiency and renewables will be at the top of the pyramid and by investing in RWE we are trying to position portfolios to benefit from these incentives. Other leadership utilities in upstream renewables trade at valuations in the 9-15x EBITDA range; however, we believe RWE clocks in at an unjustifiably low ~6x level, perhaps reflecting the vast restructuring of its business that has taken place over several years. The upside would seem considerable if the gap were to close.

Cap Gemini (CAP.FP) – is one of Europe’s largest IT consulting companies, competing at the higher end for large project integrations similar to Accenture in the U.S. Cap Gemini generates about 55% of its current revenues from “cloud and digital” projects, which are a combination of management consulting, implementing and integrating client systems into a pure cloud/hybrid cloud environment, as well as re-writing custom applications for a cloud environment. Additionally, Cap helps companies with digital transformation which by and large means automating corporate tasks and processes using both off the shelf and custom software. Unlike many of its peers, Cap Gemini is under-indexed to the legacy IT services business that are slowly (or in some cases quickly) melting away as companies automate processes and move workloads into the cloud. Here, Cap Gemini generates about 10% of its revenues from these “slow-melting ice cubes”.

The company generates an ROE of 13% (1x Net Debt/EBITDA) today with an eye towards 15% by 2022, along with operating margin targets of mid-teensIII. Cap Gemini was historically plagued by having a very high-cost labor footprint (mostly in Europe) which many of the low-cost Indian IT services companies exploited at a time when most corporations were largely focused on outsourcing IT services as a means of saving money. Therefore, despite having a strong presence in management consulting and large scale IT deployments, Cap Gemini could never compete on price. This situation has improved but is also less relevant. Most corporate priorities around IT services have shifted from one of cost to using data and IT as a means of growing revenues, retaining customers and faster product/service time to market. All of this to say that not only is Cap Gemini more competitive from a cost perspective but they have the management consulting expertise to help in large scale projects especially working closely with C-suite executive teams.

At purchase, Cap Gemini traded at a 13x 2020 P/E, or a 30% discount to Cap Gemini’s five-year average and a similar discount to the peer group average.

Recent Activity – Domestic

In our U.S. equity strategies, things were quieter, but we did make some interesting purchases, notably 5G semiconductor content companies Skyworks and Qorvo in the Large Cap and SMID portfolios respectively, and historic jeans inventor Levi’s in the SMID strategy.

Skyworks (SWKS) and Qorvo (QRVO) – are leading semiconductor companies specializing in the design/manufacture of components that enable the critical analog functions of wireless radio technologies. Both sell modules that integrate technologies such as power amps, filters, low noise amps, antenna tuners, switches, etc. These modules are optimized for physical footprint, power consumption and thermal characteristics which in turn operate the RF front end of mobile communication devices. Primary end markets are global smartphones, wireless base stations, military/industrial, tablets/wearables and Wifi. Growth has trended upward as mobile communications/computing becomes ubiquitous over time. 2020 is an important year for mobile due to the introduction of 5th Gen (5G) wireless standards. These technology paradigm shifts happen once a decade and we are at the beginning of a significant 5G ramp where the RF (radio) complexity in mobile devices increases significantly. 5G devices will require significantly more RF content and result in an addressable market which should accelerate growth. The 5G ecosystem can further expand the marketplace beyond smartphones to include billions of potential new endpoints in an Internet of Things (IoT) world. Customer concentration and China’s large presence in the global smartphone industry have created short term volatility and an attractive entry point in front of a 3-5 year 5G adoption “S Curve”.

The RF module market is a three-player oligopoly represented by Skyworks, Qorvo, and Broadcom (AVGO). We have viewed the latter as an overly-aggressive financial roll-up of technology businesses, making longer-term valuation comparisons or forecasting challenging. RF modules are an enabling technology for mobile communications, and we see RF content increasing materially in a 5G World. The key technologies are difficult to master and require the use of unique semiconductor materials such as Gallium Arsenide and Gallium Nitride-based chips. Filtration and power amps are two of the largest and most important technologies for 5G, and due to the use of a far larger range of frequencies and spectrum, the level of technical engineering needed in these modules increases markedly, creating greater competitive barriers. At purchase, both stocks traded around the 12-13x EPS range and 7-8x EBITDA, both on the lower end of normal ranges during technology cycles and somewhat surprising given the pending 5G cycle. However, the significant customer concentration for handsets and variability of the near term (due to trade issues) led to what we see as an attractive entry point.

Levi Strauss & Co (LEVI) – This is a 160 year-old denim brand (#1 market share in denim @ 12%, #2 is Wrangler @ 5%) that was outside of public markets for most of the last 30 years. The business was historically under-invested in until management arrived in 2011, which implemented a renewed culture around innovation while maintaining the authenticity & quality at the right price points that Levi Strauss is historically known for. Beyond 2019, we believe the path forward is moderate growth driven by international expansion, increasing penetration of under-penetrated product categories, omnichannel investments and a quicker supply chain/faster lead times. From an industry standpoint, the early 2010s was a stagnant fashion cycle (skinny jeans drove sales), but styles have evolved today and as the market leader, we believe Levi Strauss is well-positioned to ride this tailwind (broader adoption of wider legs, higher waists, overall greater product proliferation).

Thank you for your continued confidence in Cambiar Investors.

P.S. – Normal food works pretty well in these endurance events, and after years of experimentation, the days after go far better without sports nutrition bars. It’s mostly marketing.

IBloomberg

IIAccor

IIICap Gemini

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts may be based upon third party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.